Doublez Tourism, the Community of explorers with passion, energy and curiosity.

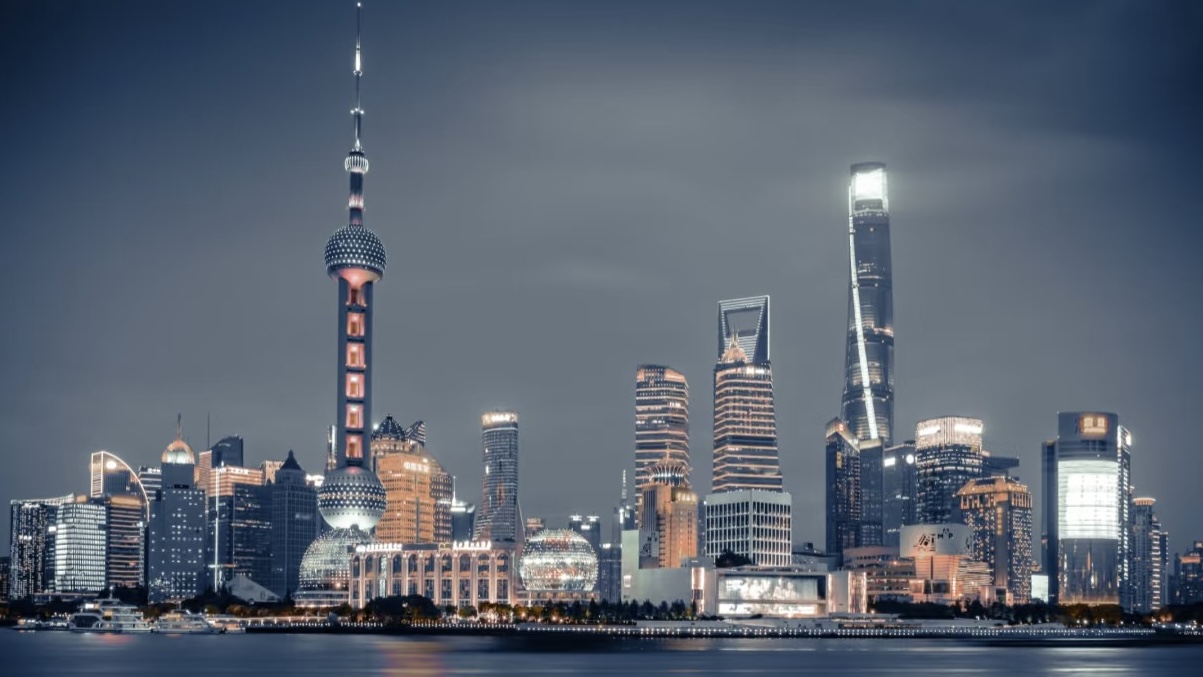

An unforgettable adventure in China awaits, Oct 20–24, 2025.

JOIN US>

More to Discover

More to Discover

Yellow Mountain

You cannot imagine what kind of mysterious nature will come until arrival in person.

INFO>